Commission calculator paycheck

You can calculator your commission by multiplying the sale amount by the commission percentage. California Salary Paycheck Calculator.

Gross Pay And Net Pay What S The Difference Paycheckcity

Need help calculating paychecks.

. Calculate your California net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free California paycheck calculator. Overview of Colorado Taxes Colorado is home to Rocky Mountain National Park upscale ski resorts and a flat income tax rate of 45. To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option.

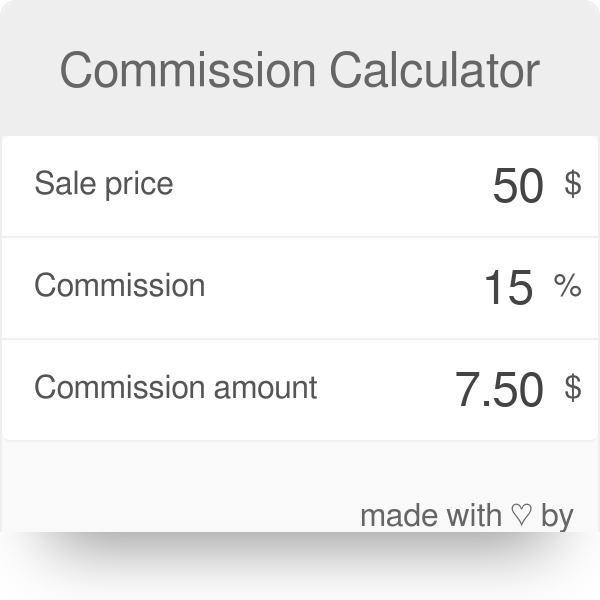

Exempt means the employee does not receive overtime pay. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. In other words if you make a sale for 200 and your commission is 3 your commission would be 200 03 6.

If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The cpi calculator consumer price index calculator exactly as you see it above is 100 free for you to use.

The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers. This California hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Then enter the employees gross salary amount. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Texas. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

Texas Hourly Paycheck and Payroll Calculator. Gross Pay Calculator Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. Click the Customize button above to learn more.

Switch to California hourly calculator. Switch to California salary calculator. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Paycheck Calculator Take Home Pay Calculator

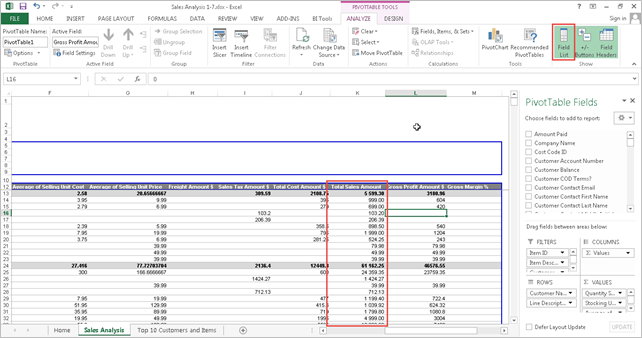

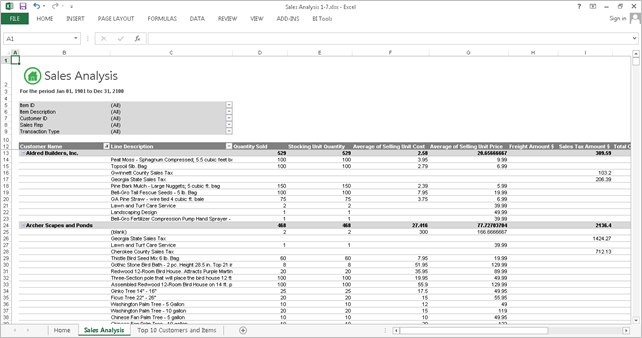

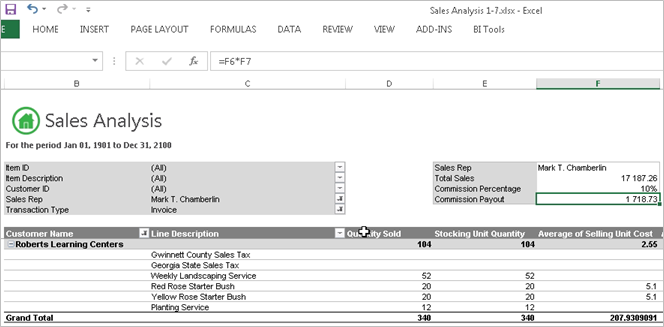

Learn How To Create A Sales Commission Calculator

Paycheck Calculator And Salary Calculator Employment Laws Com

Chapter 01 Salary And Commission Calculator Personal Finance

Paychecks Calculation Of Hourly Wages Overtime Salaries And Commission

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

4 Ways To Calculate Commission

Learn How To Create A Sales Commission Calculator

Free Paycheck Calculator Hourly Salary Usa Dremployee

Paycheck Calculator Take Home Pay Calculator

Commission Calculator

Payroll Calculator Free Employee Payroll Template For Excel

Commission Calculator Sales Commission Real Estate Commission Calculator

Payroll Formula Step By Step Calculation With Examples

Learn How To Create A Sales Commission Calculator

Paycheck Calculator Us Apps On Google Play

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022