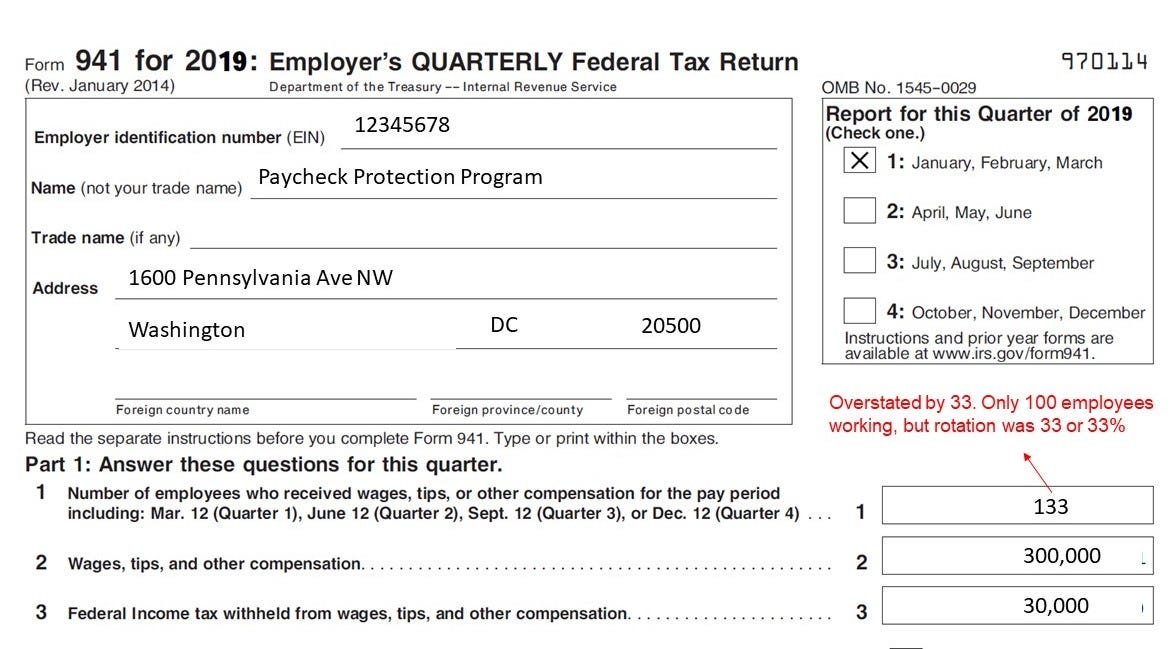

Ppp 941 calculator

The adoption of the Form 941 worksheets has proved difficult for many companies. 116-136 Likewise gross income does not include any amount arising from the.

Snip 201801051025010 Windows Phone Windows 10 Mobile Get Started

Magyarország a keleti félgömb 16 és 23 hosszúsági körei között és az északi félteke 45 és 49 szélességi körei között Európa közepén helyezkedik el a Kárpát-medencében.

. Its a fully refundable credit that can be claimed on Form 941. Find detailed information from the IRS here. The forgiveness of a PPP loan creates tax-exempt income so you dont need to report the income on Form 1040 or 1040-SR but you do need to report certain information related to your PPP loan.

PPP and KPI tool. If there is still credit left it will be refunded once you file this form. For 1099 Independent Contractors or self-employed individuals applying for a PPP loan.

Employers engaged in a trade or business who pay compensation Form 9465. The COVID-19 pandemic continues to present small businesses with new challenges and as a result the government has stepped in to offer financial relief resources. Tengerparttal nem rendelkező ország.

941 Quarterly Tax Filings 2019 2020 Q1 944 Annual Tax Filings 2019 Payroll Register for the previous 12 months. As a top-10 Small Business Administration lender 1 we used our expertise to help thousands of businesses quickly gain funds through the Paycheck Protection Program PPP a federally provided forgivable loan that covers certain business costsNow that the program has closed were here to guide you through loan forgiveness. Paycheck Protection Program PPP Loans Forgiveness For taxable years beginning on or after January 1 2019 California law allows an exclusion from gross income for covered loan amounts forgiven under the federal CARES Act Paycheck Protection Program and Health Care Enhancement Act Paycheck Protection Program Flexibility Act of 2020 the.

More specifically the ERTC is a fully refundable credit thats equal to 50 of qualified wages up to 10000 of wages per. 12 months most recent bank statements. Paycheck Protection Program PPP Loans Forgiveness For taxable years beginning on or after January 1 2019 California law allows an exclusion from gross income for covered loan amounts forgiven under the federal CARES Act Paycheck Protection Program and Health Care Enhancement Act Paycheck Protection Program Flexibility Act of 2020 or.

When you file Form 941 quarterly you can check your credit amount against the tax deposits already made during the quarter. Employee Retention Credit Worksheet 2021 Due to the COVID-19 pandemic companies in the United States have had to make various changes to Form 941 Employers Quarterly Federal Tax Return. The PPP Flexibility Act was signed into law on June 5 2020.

PPP loan effective for taxable years ending after 3272020. Key among these is the Employee Retention Credit ERC which was established in the CARES Act. Sign up for free email service with ATT Yahoo Mail.

Utilize the ERC Eligibility and Credit Calculator to see if you passed the Gross Receipts Test. The Employee Retention Tax Credit ERTC is a provision in the Coronavirus Aid Relief and Economic Security CARES Act intended to help workplaces keep employees on their payroll during the downturn caused by the COVID-19 pandemic. After completing the new eligibility assessment and 15 Minute Refund program the CPA team will.

Furthermore if a Form 941 has previously been filed and an ERC is now available an updated Form 941 can be submitted. 384520 Repayment of Informant Reward - OSPC Only. It changed the PPP to make the loans more flexible extend the time to spend loan proceeds and make other changes.

This brings their aggregate ownership to 9334. Remember you can file for this credit quarterly so check back here to estimate your credit amount for the next calendar quarter. Tőle csaknem egyforma távolságra van nyugatra az Atlanti-óceán és keletre az Urál-hegység tőle délre fekszik a Földközi-tenger és északra a.

1 day agoERTC Tax Credit Calculator Tool Launched By FederalTaxCredits. Diabetic nephropathy is more prevalent among African Americans Asians and Native Americans than Caucasians 112Among patients starting renal replacement therapy the incidence of diabetic nephropathy doubled from the years 19912001 Fortunately the rate of increase has slowed down probably because of the adoption in clinical practice of several. Its just a calculator to help you with your 2021 Form 941 computations.

The series-A new investors own 17. To see if youre eligible use the ERC Eligibility Calculator. Employers Quarterly Federal Tax Return Form W-2.

Employee Retention Credit 2021 Qualifications. Founders and investors can use it to calculate the dilution from a startup fundraise. Employers engaged in a trade or business who pay compensation Form 9465.

Any salaries that qualify for the ERC or PPP loan. Employers Quarterly Federal Tax Return Form W-2. The Human Development Index HDI is a statistic composite index of life expectancy education mean years of schooling completed and expected years of schooling upon entering the education system and per capita income indicators which is used to rank countries into four tiers of human developmentA country scores a higher level of HDI when the lifespan is higher.

Employers will be asked to upload their 941 returns raw payroll data and if they have also enrolled in the PPP program their. PPP Forgiveness Calculator. Since ERC was initially established it has undergone a number of changes and expansions.

Form 7200 may be used to request an advance payment of employer credits if the employers share of. Employers Quarterly Federal Tax Return Form W-2. Federal tax filings are due quarterly by filing Form 941 and annually by filing Form 940 but for most New York employers taxes must be paid on an ongoing basis via the EFTPS payment system.

On your Form 941 you must include both of these amounts. Installment Agreement Request POPULAR FOR TAX PROS. A free excel calculator for the y-combinator post-money SAFE.

For businesses applying for a PPP Loan. IRS 1040 Schedule C. Installment Agreement Request.

Employers engaged in a trade or business who pay compensation Form 9465. Check out How To Fill Out 941-X For Employee Retention Credit. Employers Quarterly Federal Tax Return Form W-2.

So in total SAFE own 12971. Employers engaged in a trade or business who pay compensation Form 9465. 1099s under which you were paid.

To have their rebate calculated employers will be asked to upload their 941 returns raw payroll data and if they have also enrolled in the PPP program their PPP loan documents. The forgiveness of a PPP loan creates tax-exempt income so you dont need to report the income on Form 1040 or 1040-SR but you do need to report certain information related to your PPP loan. To be regarded as an eligible business for the ERC your company must be regarded as a qualified.

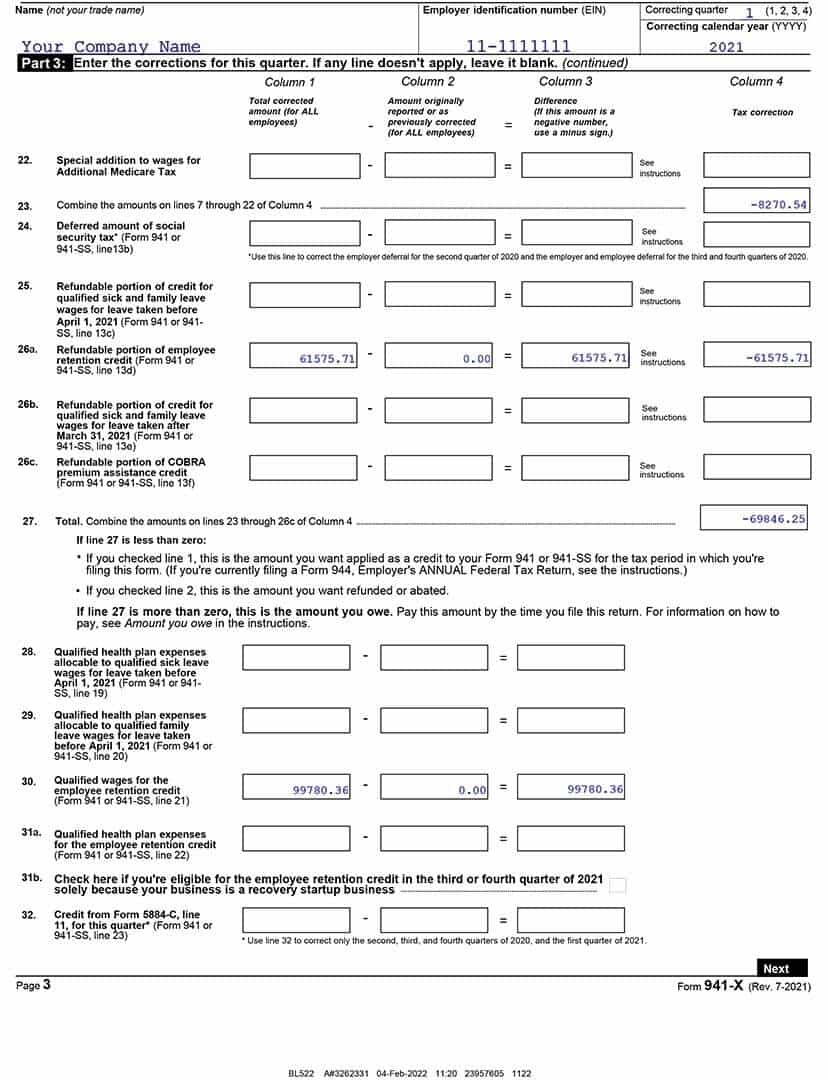

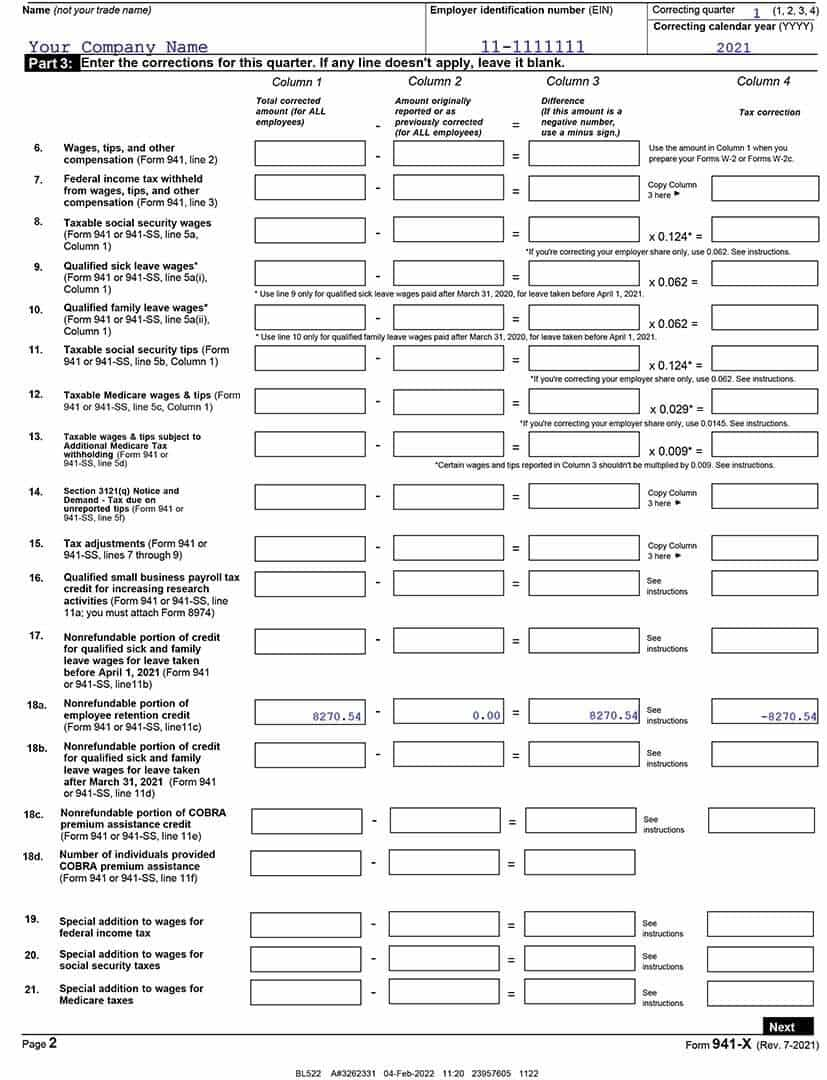

VC questions you will be asked. Employers that received a PPP loan and would like to retroactively claim the ERTC for past quarters can now file Form 941-X Adjusted Employers Quarterly Federal Tax Return or Claim for Refund. Here youll find details including the.

The 14 weeks needed to incur the 300000 of payroll for the second draw PPP debt forgiveness will be met by May 17 th which is ample time prior to the covered period end date of June 26 th.

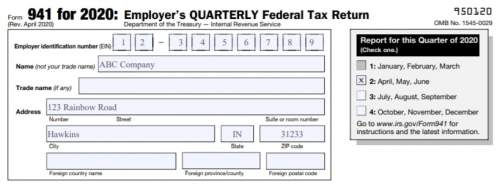

Updated Form 941 Irs The Latest Changes For Q2 Q4 2020

2

Us Updates To Form 941 Help Center

Form 941 Frequently Asked Questions

Step By Step How To Guide To Filing Your 941 X Ertc Baron Payroll

Us Updates To Form 941 Help Center

Us Updates To Form 941 Help Center

2

Irs Releases New Draft Of Form 941 For 2020 Laporte

Guest Column Employee Retention Tax Credit Cheat Sheet Repairer Driven Newsrepairer Driven News

How To Fill Out The New Form 941 When You Have Ppp Or Eidl Youtube

Step By Step How To Guide To Filing Your 941 X Ertc Baron Payroll

How To Fill Out The New Form 941 When You Have Ppp Or Eidl Youtube

How To Calculate The Number Of Full Time Equivalent Employees Ftees By George Benaroya Medium

Us Updates To Form 941 Help Center

How To File Form 941 For The 1st Quarter 2021 Taxbandits Youtube

Us Updates To Form 941 Help Center